Indian Government’s policies towards the Gem & Jewellery Sector and the way forward…

The Gem & Jewellery industry involves the following:

- High foreign exchange

- High value of transactions on gold & precious stones imports

Government Policies which were laid down for the Gem & Jewellery Industry in sequential order:

- January 21, 2013: Increase in import duty on gold and platinum from 4% to 6%

- May 13, 2013: RBI restricted the import of gold on consignment basis

- May 27, 2013: RBI prohibited advances granted by NBFCs for the purchase of gold in any form, including primary gold, gold bullion, gold jewellery, gold coins, units of gold Exchange Traded Funds (ETF) and units of gold mutual funds

- June 4, 2013:

- Government of India increased the import duty on gold and platinum from 6% to 8%

- RBI directed that all Letters of Credit (LC) to be opened by Nominated Banks/Agencies for the import of gold under all categories will be only on 100% cash margin basis

- July 22, 2013:

- Guidelines issued in May and June 2013 were withdrawn

- Introduction of 20/80 scheme: It was directed that nominated banks/agencies to ensure 20% of imported quantity of gold to be made available for exporters.

- RBI also asked banks and credit card companies to discontinue the EMI option for online jewellery purchase.

- August 13, 2013: Government of India increased the import duty on gold and platinum from 8% to 10%

- August 14, 2013

- RBI again prohibited Gold-on-lease after withdrawing the ban in July 2013

- Prohibition of imports of gold coins and medallions

- Further, it was directed that, gold will be made available to only jewellers/bullion dealers/banks involved in gold deposit scheme after upfront payment of cash

- September 18, 2013: Government of India increased the import duty on gold jewellery from 10% to 15%.

- March 19, 2014: RBI eased gold import norms by allowing five domestic private banks – HDFC Bank, Axis Bank, Kotak Mahindra Bank, Indusind Bank and YES Bank to import gold in the country.

- April 1, 2014: RBI lifted restrictions on a number of mines abroad, to which advance remittances can be extended for imports of rough diamonds. Banks were allowed to have their own discretion to extend advance remittance to Indian importers in favour of global miners.

- May 21, 2014: RBI further eased gold import norms by allowing Star trading houses/premier trading houses (STH/PTH), registered as nominated agencies by the Director General of Foreign Trade (DGFT), to import gold under 20/80 scheme.

- May 21, 2014: Gem & Jewellery players were allowed to avail Gold Metal Loan (GML), thereby enabling procurement of gold on lease basis.

- November 28, 2014: Withdrawal of the 80/20 import rule

- Feb 18, 2015: RBI lifts ban on import of gold coins, medallions by banks & trading houses. RBI allowed banks to give gold on loan to jewellers.

- September 15, 2015: RBI introduces gold monetization scheme.

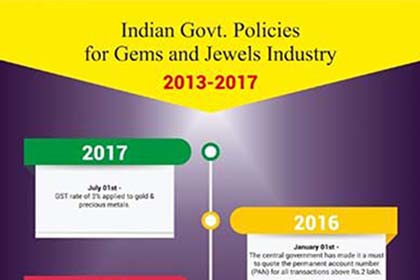

- January 01, 2016: The central government has made it a must to quote the permanent account number (PAN) for all transactions above Rs.2 lakh.

- April 01, 2016: The government imposes 1% of excise duty on jewellery manufacturing.

- July 01, 2017: GST rate of 3% applied to gold and precious metals.

- February 01, 2018: Government of India makes e-Way Bill mandatory for all movement of goods above INR 50,000/- within the country but exempts Gem & Jewellery from it.

1) The future for the industry…

- Retail jewellery segment in the country is expected to see double digit growth rates in revenue in FY18 on back of regulatory headwinds fading out and continued favourable demographics. Margins of retail players are expected to see improvement over medium term with availability of gold metal loans and increase in share of higher margins diamond and precious stone studded jewellery.

- Branding would continue to gain significance. Share of national and regional organized jewellery retailers is expected to grow.

- Retailers are also expected to see some benefit from the revival of the gold savings scheme and increase in limit of the amount collectible under the scheme to 35% of net worth.

- Overall domestic gems & jewellery demand would see a growth of 6% – 7% in volume terms over a medium term.

- Globally gems & jewellery would see mix consumption pattern with more people moving up in some parts of the world to higher carat and higher value pieces on one hand; and price war at the lower end of the market.

- Supply of rough diamonds is expected to continue to remain tight going ahead which would push up the rough diamond prices. A balance is expected to be maintained with the demand.

- Pressure on profit margins for cut & polished diamond exporters (midstream players) would continue over near to medium term. The global gems & jewellery demand continue to remain lacklustre with no major pick-up in demand from US or China and continued uncertainties in UK and Europe in early 2017. Given the lack of bargaining power with the midstream players and extremely thin profit margins, smaller midstream players may find it unviable to operate as the current scenario extends.

- However, India overall is expected to continue to gain share in the rough diamond trade globally. De Beers recently has set up their auction sale centres in Mumbai, India while shutting down the Dubai centre. The global rough diamond auction business has started shifting to Mumbai since the establishment of the special notified zone in the Bharat Diamond Bourse in 2015.